Probate Appraisal Coral Springs

Probate Appraisal Coral Springs | Empire Appraisals

Probate Appraisals in Coral Springs / Broward County

Losing a loved one is never easy. On top of the emotional weight, families and executors must handle the legal and financial steps of probate. One of the most important responsibilities is establishing the value of the estate. That’s where a Probate Appraisal Coral Springs service becomes essential.

At Empire Appraisals, we provide accurate, unbiased probate appraisals for real estate. Our goal is to make this process as smooth as possible for families, executors, and attorneys in Coral Springs, Parkland, Coconut Creek, and throughout Broward County. With licensed Florida appraisers and years of local market experience, we deliver reports that are fair, defensible, and court-ready.

What Is a Probate Appraisal?

A probate appraisal is a professional evaluation of a deceased person’s property at its fair market value. This valuation is usually based on the date of death and is required for probate court filings, estate division, and sometimes for IRS reporting.

Why it matters:

- Fairness – Ensures heirs and beneficiaries receive an equitable share of the estate.

- Legal compliance – Required by probate courts in Florida and used in IRS estate tax filings.

- Clarity – Reduces disputes among heirs by providing a clear, objective valuation.

- Financial planning – Helps executors and attorneys make informed decisions about asset distribution, taxes, or property sales.

If you’re an executor, personal representative, or family member in Coral Springs, a Probate Appraisal Coral Springs ensures the estate process moves forward fairly and legally.

When Do You Need a Probate Appraisal?

Not every estate asset requires an expert appraisal. However, probate law in Florida requires accurate fair market values for major estate property. Common situations where you’ll need professional help include:

- Filing probate court documents – Executors must submit an inventory with appraised values.

- Estate taxes – Larger estates may require IRS-compliant appraisals.

- Selling inherited property – Establishing a fair asking price for a home or land.

- Dividing assets among heirs – Ensuring everyone receives a fair share of value.

- Avoiding disputes – An impartial report helps prevent disagreements.

Example: A Coral Springs family inherits a home appraised at $450,000 at the time of death. The executor uses that report to file with the Broward County Probate Court, then relies on the valuation for settlement negotiations with heirs.

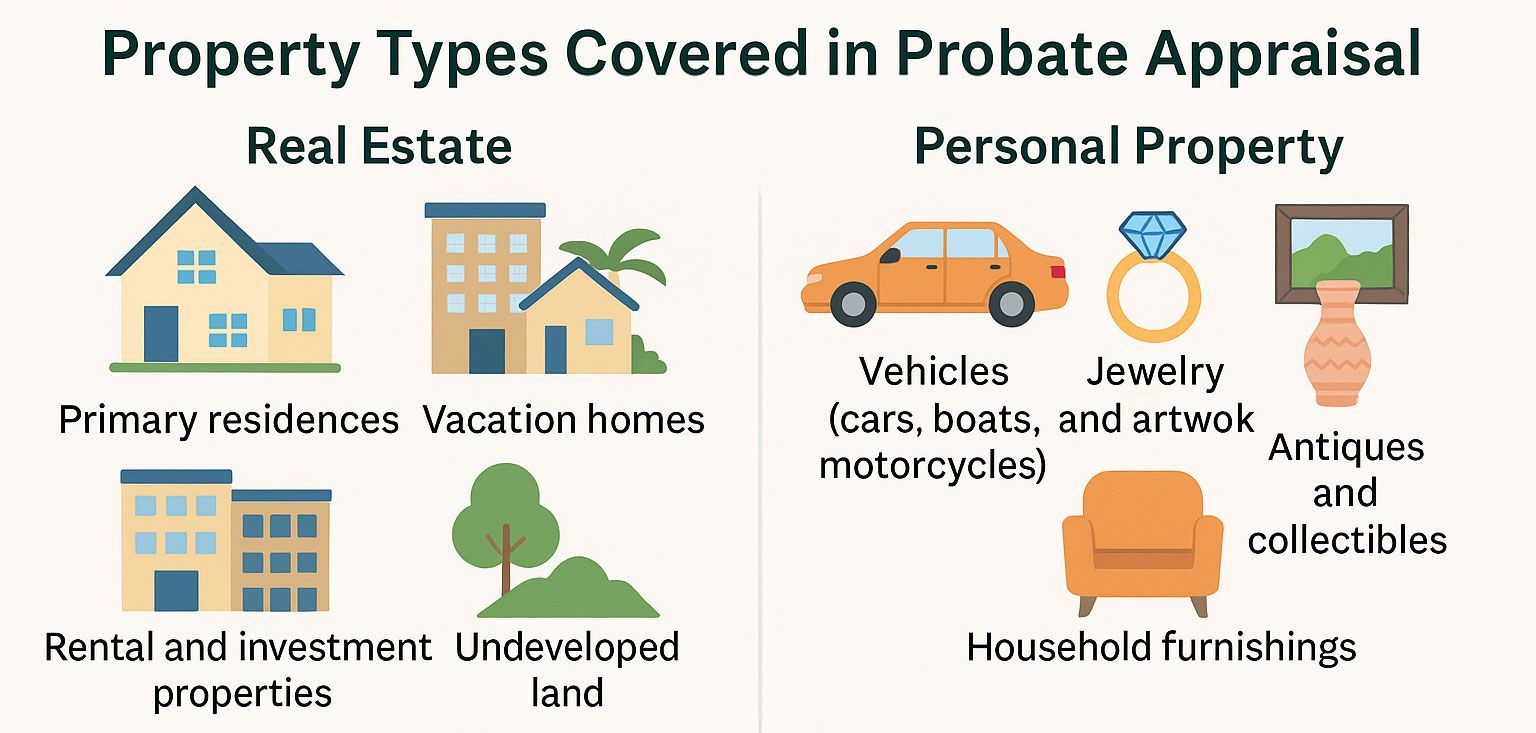

Property Types Covered in Probate Appraisal Coral Springs

Empire Appraisals specializes in real estate probate appraisals but also provides assistance with certain personal property valuations. Assets often included in a probate appraisal are:

Real Estate

- Primary residences

- Condominiums

- Vacation homes

- Rental and investment properties

- Undeveloped land

Personal Property

- Vehicles (cars, boats, motorcycles)

- Jewelry and artwork

- Antiques and collectibles

- Household furnishings

For more complex assets like businesses, intellectual property, or rare collections, we can coordinate with attorneys and specialized appraisers.

Methods Used in Probate Appraisal

When performing a Probate Appraisal Coral Springs, appraisers select the valuation method that best fits the asset:

- Market Approach – Uses comparable sales data for homes or property.

Example: A Coral Springs home is valued by analyzing recent sales of similar homes in the same neighborhood. - Income Approach – Used for income-generating properties.

Example: A rental duplex in Coconut Creek may be valued based on rental income and future earnings potential. - Cost Approach – Estimates value based on the cost of replacement.

Example: A rare antique piece of furniture may be valued by determining what it would cost to replace it with a similar item.

Our goal is to ensure every appraisal is objective, accurate, and defensible if challenged in probate court.

Our Probate Appraisal Process

Empire Appraisals has designed a clear, step-by-step process to support families and executors:

- Consultation – We discuss your needs, timeline, and assets to be appraised.

- Property Inspection – For real estate, we visit the property to document size, condition, and features.

- Market Analysis – We research comparable sales, income potential, or replacement costs.

- Report Preparation – You receive a detailed, court-ready appraisal report.

- Ongoing Support – If attorneys, courts, or the IRS require clarification, we provide follow-up support.

Timeline: Most reports are completed in 5–7 business days. Rush service is available if probate deadlines are tight.

How Probate Appraisals Are Used in Coral Springs

A Probate Appraisal Coral Springs is more than just a number - it shapes the entire estate process. Common uses include:

- Equitable Distribution – Ensuring heirs each receive fair value.

- Property Buyouts – If one heir wants to keep the home, the appraisal determines the buyout price for others.

- Tax Compliance – Estate tax and capital gains planning.

- Court Proceedings – Probate judges rely on appraisals when deciding asset division.

Preparing for a Probate Appraisal

Executors and families can make the appraisal smoother by preparing ahead of time. Here’s what to gather:

- Property deeds and titles

- Recent mortgage statements and tax records

- Records of improvements or renovations

- Lists of major household items or collections

- Access arrangements for real estate inspections

By providing this information upfront, you’ll help ensure the report is delivered quickly and accurately.

Why Choose Empire Appraisals for Probate Appraisal Coral Springs

- Licensed Florida Appraisers – Trusted in Broward County courts.

- Local Expertise – Deep knowledge of Coral Springs, Parkland, and Coconut Creek real estate markets.

- Court-Ready Reports – Structured to meet legal and IRS standards.

- Compassionate Service – We understand the sensitivity of probate and work with empathy and discretion.

FAQs About Probate Appraisal Coral Springs

What is a probate appraisal?

It’s a professional valuation of estate property, usually real estate, for use in probate court, estate settlement, and IRS reporting.

How long does a probate appraisal take?

Most reports are completed within 5–7 business days after inspection. Rush service is available.

Who pays for the appraisal?

The estate typically pays for the appraisal, though arrangements may vary depending on agreements among heirs.

Can one appraisal be used for all heirs?

Yes. A single, impartial appraisal helps prevent disputes and ensures fairness.

What happens if heirs disagree with the value?

Courts may require additional appraisals, but our reports are designed to be clear, defensible, and accepted by attorneys and judges.

What qualifications should a probate appraiser have?

Always work with a state-licensed appraiser. Empire Appraisals is fully licensed in Florida and experienced with probate cases.

Do you handle IRS requirements?

Yes. We prepare appraisals that meet IRS standards for estate tax and date-of-death reporting when needed.

Probate Appraisal Coral Springs | Call Today

Probate can be overwhelming, but the appraisal doesn’t have to be. At Empire Appraisals, we provide compassionate, professional probate appraisal services to help families and executors move forward with confidence.

Call us today at

(954) 263-1312 or Request an Appraisal Online