Real Estate Appraiser Coral Springs

Whether you are buying a home, selling, refinancing, or managing an estate, working with a qualified real estate appraiser in Coral Springs is essential. An accurate appraisal ensures fair pricing, satisfies lender requirements, and provides peace of mind during major financial decisions.

In this post, we will explain what a real estate appraisal involves, why it matters in Coral Springs, and how Empire Appraisals delivers accurate results with fast turnaround times based on more than 20 years of experience.

What Is a Real Estate Appraisal?

A real estate appraisal is a professional, unbiased estimate of a property's market value. It is most often required by lenders during the mortgage process but is also used in estate settlements, divorces, tax appeals, and pre-listing evaluations. The appraisal is conducted by a state-certified real estate appraiser who inspects the property, analyzes comparable sales, and considers market trends.

Why Appraisals Matter in Coral Springs

Coral Springs is a diverse and growing real estate market. With a mix of townhomes, single-family homes, and luxury properties, accurate property valuations are critical. A qualified real estate appraiser in Coral Springs understands the local market, neighborhood trends, zoning laws, and property types specific to this region.

Inaccurate valuations can result in overpaying for a property, mortgage loan denials, or deals falling through. That is why working with a seasoned local appraiser is so important.

Empire Appraisals: Coral Springs Appraisal Experts

Empire Appraisals has provided real estate appraisal services in Coral Springs and the surrounding South Florida area for over two decades. The team serves homeowners, buyers, real estate agents, attorneys, and lenders across a wide range of needs.

Our Services Include:

- Residential real estate appraisals

- Divorce appraisals

- Estate and probate appraisals

- Pre-listing valuations

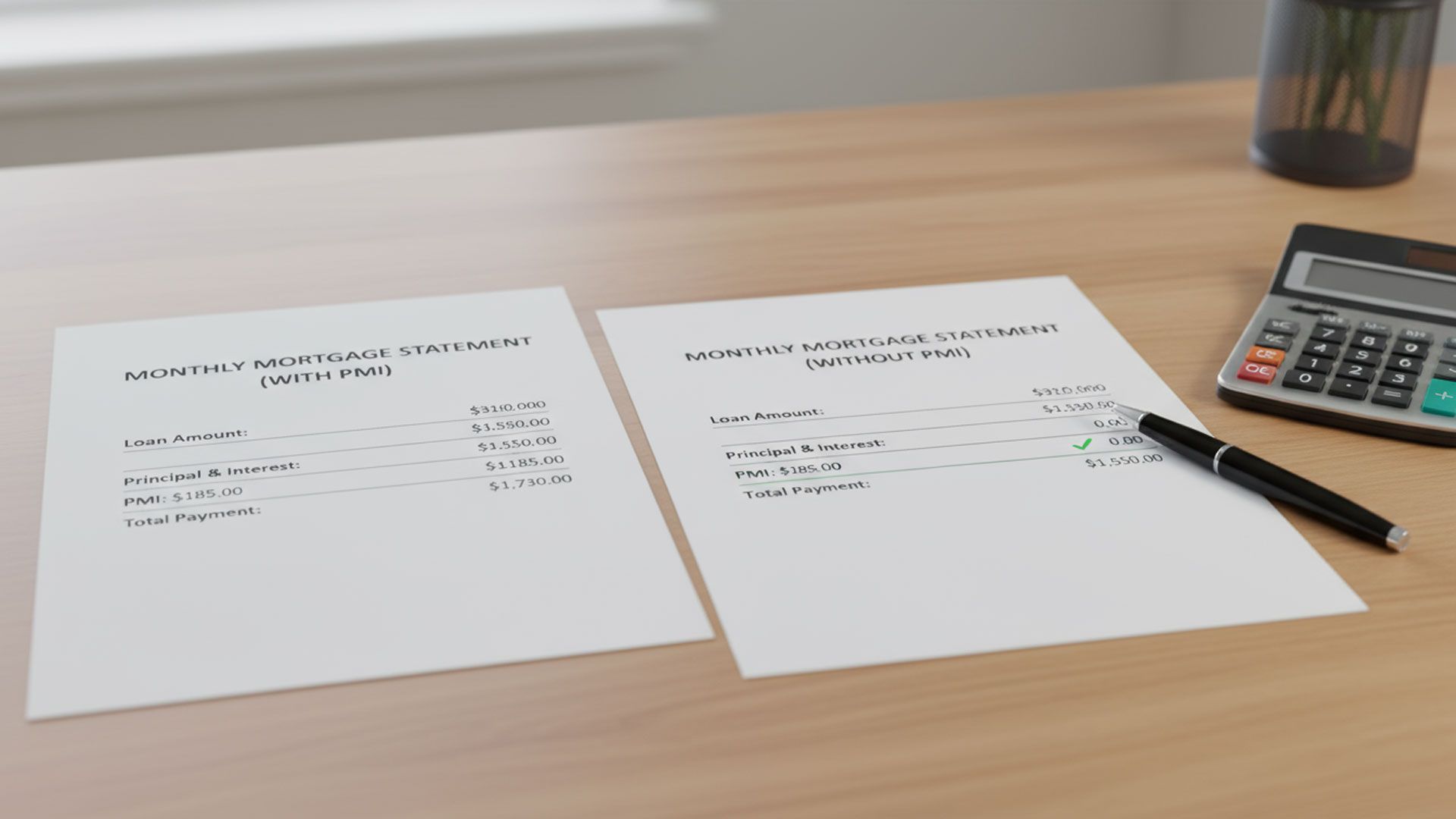

- PMI removal appraisals

- Refinance appraisals

- Tax appeal support

- Date of death appraisals

- Expert witness testimony

Empire Appraisals is known for providing fast, reliable appraisals without sacrificing accuracy. Most appraisals are completed within 24 to 48 hours following the inspection.

Who Needs a Real Estate Appraisal in Coral Springs?

Appraisals are critical in a variety of situations:

- Homeowners: A pre-listing appraisal helps set the right asking price and reduces the risk of deals falling through.

- Buyers: Lenders require appraisals to ensure the home’s value matches the loan amount.

- Attorneys and Legal Professionals: Divorce, estate, and probate cases often require a certified appraisal for legal proceedings.

- Refinancing Homeowners: An updated appraisal is often necessary to qualify for better loan terms or remove private mortgage insurance (PMI)..

How to Prepare for a Home Appraisal

There are steps you can take to help ensure the best possible outcome:

- Clean and declutter the property

- Make minor repairs and touch-ups

- Compile a list of recent upgrades

- Ensure all utilities are functional

- Provide easy access to all rooms, garages, and outdoor spaces

While cosmetic improvements will not drastically change the value, a well-maintained and organized home helps the appraiser form a more favorable impression.

Why Choose Empire Appraisals for Coral Springs Appraisals

When selecting a real estate appraiser in Coral Springs, experience and local expertise matter. Empire Appraisals stands out because of:

- Over 20 years of experience in South Florida

- Certified, insured, and compliant with USPAP standards

- Rapid 24 to 48-hour turnaround

- Detailed and transparent reports

- Familiarity with Coral Springs neighborhoods and market conditions

Ready to Schedule a Real Estate Appraisal in Coral Springs?

Whether you need an appraisal for a home sale, refinance, divorce, or estate matter, Empire Appraisals provides professional, timely, and accurate service. To get started, contact us today.

Call us today at (954) 263-1312 or Request an Appraisal Online

Frequently Asked Questions (FAQ)

What does a real estate appraiser look for? A real estate appraiser evaluates a property's size, condition, location, upgrades, and comparable sales to determine its market value.

How long does a home appraisal take? The on-site inspection typically lasts 30 to 60 minutes. The complete report is usually delivered within 1 to 3 business days.

What hurts a home appraisal the most? Major issues like structural damage, poor maintenance, outdated systems, and undesirable location factors can reduce the appraised value.

Can I prepare my home to increase its appraised value? Yes. Cleanliness, minor repairs, a list of upgrades, and good overall presentation can contribute to a better appraisal outcome.

What happens if the appraisal comes in low? If the appraisal is below the agreed sale price, the buyer may need to renegotiate, pay the difference, or cancel the deal. A second appraisal or dispute may be possible.

How is an appraisal different from a home inspection? An appraisal determines a property's value. A home inspection evaluates the condition of systems and structure.

Is a home appraisal required for refinancing? Yes. Most lenders require a new appraisal to confirm the current market value of the property before approving a refinance or removing PMI.

How much does a real estate appraisal cost in Florida? Residential real estate appraisals in Florida generally cost between $350 and $600, depending on the property size and complexity.

Call us today at (954) 263-1312 or Request an Appraisal Online