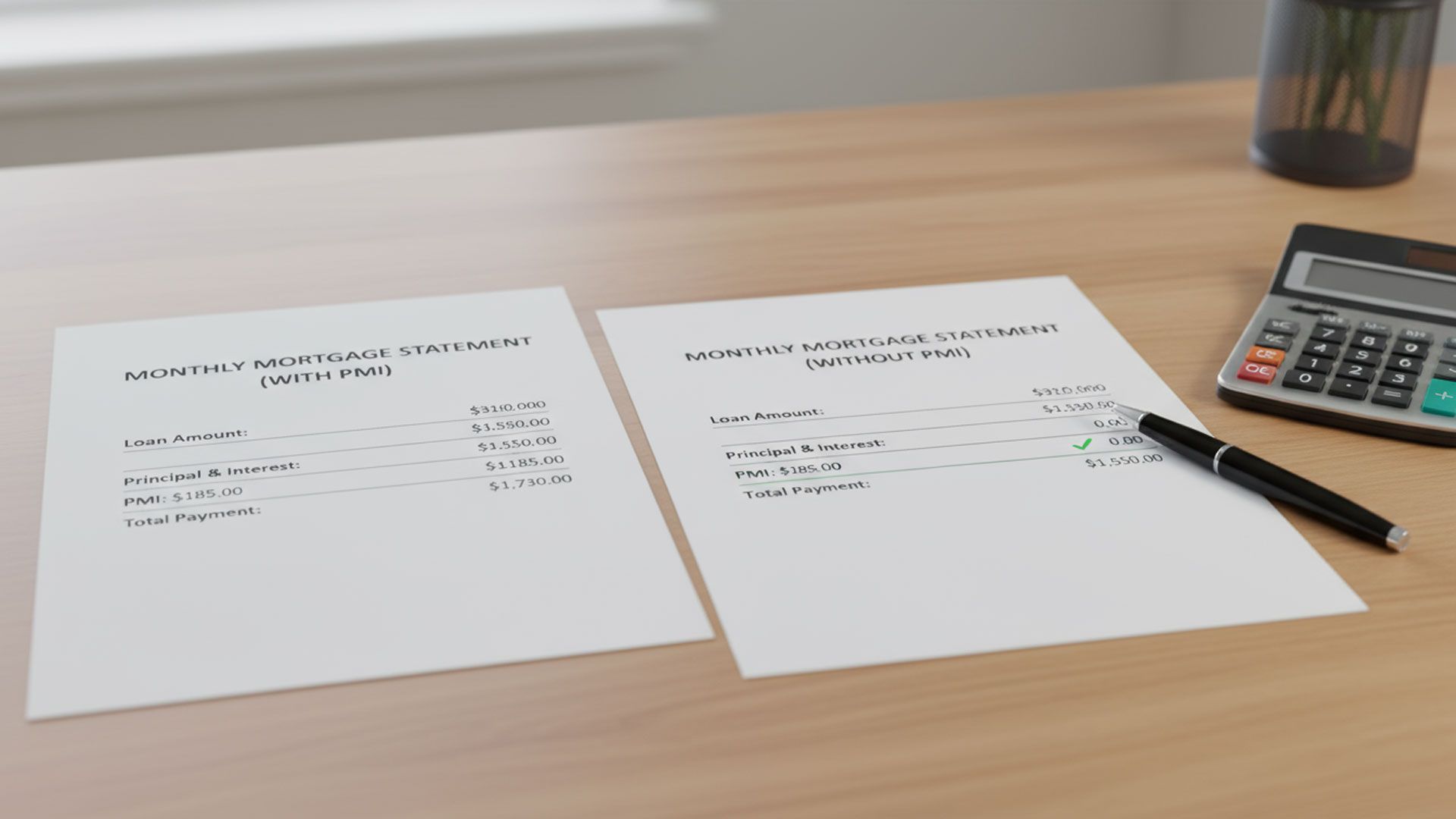

Appraisal to Remove PMI Coral Springs: What You Need to Know If you're a homeowner in Coral Springs, there's a good chance you’re paying private mortgage insurance (PMI) on your home loan. And if your property value has increased or you’ve paid down a good portion of your mortgage, you may qualify to remove PMI through a home appraisal. In this article, we’ll walk through everything you need to know about scheduling an appraisal to remove PMI in Coral Springs . We'll also explain why choosing a seasoned local appraiser with more than 20 years of experience gives you a distinct advantage during this process. What Is PMI and Why Do Homeowners Want to Remove It? Private mortgage insurance (PMI) is typically required on conventional loans when the down payment is less than 20%. PMI protects the lender—not the homeowner—in case of loan default. It’s an added monthly expense that can cost hundreds or even thousands of dollars per year. While lenders automatically cancel PMI once your loan balance reaches 78% of the home’s original value, many Coral Springs homeowners reach 20% equity much sooner due to: Home appreciation in South Florida Mortgage principal paydown Rather than wait for automatic cancellation, you can request PMI removal early - and that’s where an appraisal comes in.